Charlotte Black FCSI (Hon) has experience as both a board member and in non-executive roles. She is an experienced champion of major changes in financial market infrastructure with a reputation for campaigning for participants in retail financial markets and on corporate governance issues, as well as her long held interests in the arts and education. She was a Director of Marketing and Public Affairs at Brewin Dolphin for 27 years and Chairman of its Stewardship Committee. Charlotte was also a Non-Executive Director of CrestCo, Euroclear plc, the CISI and the WMA variously between 1996 and 2016.

‘The market is a good servant – but a bad master’. Lord John Eatwell

Capitalism is a vital and positive force and the future of nations and citizens depend on its continuing success, as was well explained in the Government’s Green Paper on corporate governance reform in November 2016. However, trust and confidence in corporate governance has been lost and a chasm opened up between business and its wider stakeholder base. The failings of corporate governors and the long complex supply chain between savers and their underlying shareholdings (most savers are unaware they have a stake) both contribute to this burgeoning discontent.

There is growing disaffection with UK PLC and globalisation more generally and too little corporate engagement with investors, employees, suppliers, and customers. The ever-widening pay gap and one rule for the boss and another for everyone else deepens the fault line. The only shareholders who have the opportunity to vote are institutions, but they are under short-term pressures and often in the same pay group as the bosses they are meant to police, while citizens have no direct relationship with UK plc: there is a need to reconnect.

These grievances add fuel to an ominous anti-capitalist insurgency. How do we make business and bosses more accountable and everyone else aware that we are all stakeholders and that it is in all our interests for business to flourish?

The Government’s response to their consultation reports that 86 per cent of respondents agreed that stakeholders’ voices need to be strengthened – but none concurred how it might be done. The proposals announced in August broadly advocate more transparency about directors’ compliance with their responsibilities to employees and stakeholders under s.172, but are generally flimsy and fail to suggest any new and imaginative ways of engagement. There is a choice of three mechanisms for employee representation on boards, but each of which, the paper acknowledges, has its own drawbacks, and they are unlikely to draw in views of any more than a tiny cohort of discontents.

Meanwhile, the Corbyn-led Labour Party is harking back to sweeping nationalisation as the solution, and denigrating the social liberation of the Blair and Cameron eras, which has delivered prosperity and consumer choice in various degrees to almost all in society. However, corporate Britain — let alone some multinationals — is not behaving or being seen to behave as the new populist generation expect and who now wish to control and tax it more, which is a deadly combination for jobs and prosperity.

The freedom of enterprise from the dead hand of the state is not universally considered a benefit by many these days; they probably don’t remember British Airways and BT as national carriers and general laughing stocks before their privatisation. These and many other flotations led to lower fares and tariffs, expanded and improved services: BA became the world’s favourite airline. But now many seem autocratic, complacent, and out of touch with their staff and the new generation of consumers, despite their obvious successes.

Today three quarters of all households in the UK have some form of invested savings. Soon, through auto-enrolment, which is one of the most promising Government policies in recent times, all working people will have a stake in UK PLC, and should be able to give a view on how it behaves. With fast-developing technology, auto-enrolment should soon lead to a personal valuation of their fund on an individual’s phone, which could follow them from job to job, and from which they could know their principal shareholdings. They will be able to be aware and shop accordingly — e.g. Vodafone not Sky, and Morrisons instead of Tesco, or vice versa – as well as responding to polls on ‘their’ CEOs’ pay or other matters of corporate behaviour.

Such facilities could only be a matter of time away with new smart technologies and will not require complex legislation or regulatory box ticking. Tech could enable us all to put up or shut up on corporate governance matters and dent the socialist argument for coercive and restrictive practices, which are the antithesis of the free market. Encouraging such engagement and transparency will support the fundamental freedoms that allow capitalism to flourish and bring prosperity to all.

Shareholder powers and executive pay

Following political and media pressure, it can be argued that the message on executive pay is beginning to get through, within existing law, to its relatively small audience of interested professional investors. BlackRock, one of the world’s largest investors, recently announced it will not support the re-election of board directors who fail to rein in outsized pay packets. In a letter in January this year to the bosses of more than 300 UK companies, BlackRock, which has a stake in every business listed on the FTSE 100, said that it would only approve pay increases for Directors, if the companies increased workers’ wages by a similar quantum. The Blackrock letter and similar stands taken by Standard Life Aberdeen and other institutions are arguably more powerful than any more rules or regulations.

Nonetheless, there is a need to broaden engagement beyond the narrow cohort of institutional shareholders.

According to Edelman’s 2017 Trust survey [1], we are experiencing a collapse in trust in the institutions and corporations that shape our society. Trust in the UK is at an historic low of only 29 per cent overall and UK business at 33 per cent; this is expected to dwindle further unless business engages with the people and delivers solutions to their concerns. ̍

Encouraging institutional and retail shareholders to use existing powers

Fund managers do mostly report their voting record as part of their obligations under the FRC Code – however, few (of their underlying investors or customers) are aware or interested in finding these records as they are usually buried in the depths of impenetrable websites or annual reports. There is little interest or incentive for these institutions to engage with their underlying clients on matters of corporate governance. Institutional investment managers do an essential job – increasing the value of the nation’s savings, and they see this as their primary function, but not to engage with the public.

- UK funds industry manages £4.3 trillion of assets, in pensions, ISAs, and other collective investment products. On behalf of 11m citizens in ¾ of homes in the UK.

- “Having access to Financial Services and expert investment management is critical for most people to participate fully in society” – said the FCA in October 2016. But – other than an annual statement or a sales brochure – there is little or no communication between managers and savers.

It is only when significant numbers of savers and investors are given a role in corporate governance that this tide will turn. Fund managers will have to take more account of the views of their customers and the media will have an incentive to express opinions to a large and receptive audience at last.

There is no wish to undermine the existing nominee custodial arrangements which are the only cost-efficient method of share ownership for small savers and investors. Equally, there is no point in enhancing the rarely used proxy arrangements introduced in 2006 – for which there is little appetite as they are cumbersome and expensive.

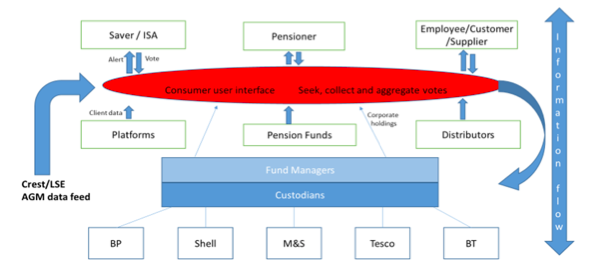

Now a new form of stakeholder engagement and communication needs to be developed and is possible using smart technology. For example:

1. Savers’ annual ISA or pension statement could include a free offer to register ‘to have your say’:

- sign up for alerts to e.g. FTSE 100 and 250 companies’ AGM notices for companies within their pension or investment product

- receive alerts and a simple polling card – e.g. to approve the remuneration report and the dividend

- tick For or Against in ‘one man one vote’ ADVISORY poll

2. Option to extend facility to employees and other stakeholders of both public and private companies

3. ‘Votes’ aggregated and supplied to registered shareholder/fund manager/board

4. Poll results published alongside the registered institutional shareholders’ actual votes

5. Registered shareholders either comply with poll ‘advice’ – or explain why not

This ‘enfranchisement’ of even a proportion of the 11m individuals in equity-related savings products today and the soon to be millions more through auto-enrolment, could be akin to the 1980s\ sale of council houses in terms of its political awakening.

How it could work

There are nonetheless challenges as well as opportunities within this proposal:

- Engaging underlying savers and investors’ participation

Savers and investors are notoriously hard to engage and there will need to be a pilot to test public appetite. However, the press will support and provide information on contentious issues and the service will be free to users — it will be simple and with alerts sent direct to users’ phones or inboxes – creating awareness and encouraging action.

- Complex data-matching challenge

Technical developments make it possible and there is a willingness of some of the biggest providers of retail financial services to consider a pilot.

Are not yet quantified – but it is a data management exercise and an opportunity for a customer user interface, possibly a polling organisation, to build databases and provide enhanced services – including information, e.g. PIRC data, user chat rooms, etc.

None should be required as voting/polling would be purely advisory – though political will and support would be a vital ingredient and a spur to the development of a necessary pilot

Strengthening the employee, customer, and wider stakeholder voice

This form of engagement will be straightforward between companies and their employees. Information about strategy, the future plans for the business, and the firm’s remuneration policy could be sent to all permanent employees with an opportunity for staff to express a view anonymously on whatever issues they are invited to comment on. Results would be aggregated and published in a pie on the company intranet. It should also be used to encourage employees to become shareholders. Both would be preferable outcomes to the proposed Designated NEDs, employee councils, or employees on Boards.

Such an advisory polling facility, with voting prior to AGMs as described, should attract much broader engagement and satisfaction. The facility should certainly be extended to employee shareholders and possibly to all permanent employees, account customers, suppliers – shareholders via pensions and ISA wrappers, and indeed whomever the Company wished to engage with. Votes would not be binding and no challenge to Company Law — they would be aggregated and anonymous; it would be their publication that wielded the power.

Boards would soon know if their policies were unacceptable or just misunderstood and would be keen to address any concerns, in fear of poor publicity. FRC guidance would be sought to set parameters for such a facility and agree the form of its reporting.

FTSE 100 and 250 companies should be a manageable aspiration for broad stakeholder participation – perhaps starting with FTSE 100 for the underlying shareholders in pensions and savings schemes. Though any company could join the scheme or not – and would do owing to likely peer and public pressure and the efficacy of the “have your say” app that is developed.

Legislation, code based or voluntary?

All voluntary. Any mandatory requirements would add more complexity with the need for audit trails of potentially huge and confidential data – adding inexorably to costs. As the ‘vote’ or poll would be advisory, votes would be cast anonymously – it would be publicity and peer pressure that would steer boards’ behaviour and ensure remuneration is more closely linked to performance – rather than another tick box exercise.

Private companies…could they be in scope?

The benefits of a stakeholder polling facility would be in the interests of good relations with employees and customers of every company of any size. Though for private companies’, new guidelines may be necessary.

To avoid a BHS type scandal, it should be noted that existing employee rights, auditors’ probity, and the requirements of pension trustees should each have prevented much of the BHS catastrophe. Relevant legislation should be reviewed and strengthened where necessary, but such a scandal could not have been prevented by any corporate governance code, existing or proposed.

Private limited liability companies’ stakeholder engagement will depend on the sector, number of employees, customers and suppliers – say a minimum of 1000 stakeholders in aggregate as suggested in the Government’s August proposals. A code of good practice could be drawn up by the IoD and CBI and while it might include some of what is in place for listed companies, it would need to be tailored specifically and operable within the Companies Act if it were to work well and encourage private business to engage.

Adherence to a best practice code for stakeholder engagement should be voluntary with transparent results. The comply or explain principle applies just as well here. Both public and private corporations are aware of growing distrust and the wave of populism that threatens them, and their attempts to appear more local and ‘caring’ and in touch are increasingly apparent through their social media feeds.

The right combination of high standards and low burdens

The key principles at the heart of UK corporate governance – that is unitary boards and shareholder rights and the voluntary nature of comply or explain with its high standards and low administrative burden – would each be enhanced by broader inclusion of other stakeholders’ views. The awakening of registered shareholders (institutional investors and trustees) acting on behalf of millions of smaller investors, savers, and pensioners in both passive and active funds, should result in more consideration of their responsibilities and engagement with their underlying customers — while these customers would realise that they do have a stake and it is in their interests for the companies in which they are invested to do well, make profits, and to employ the very best talent.

We can’t turn the clock back on global capitalism – it slips around the world with ease – but we can enable savers, employees, and consumers to have a say on how it performs. Labour abandoned its loathing for economic liberalism in the 1980s, leading to the collapse of socialism as a credible programme for government; but now Conservatives must relaunch capitalism, making it more engaging and accountable – to save it from a socialist resurgence. This Labour Party is not bothering with a 1990s’ style prawn-cocktail offensive – it stokes anti-business sentiment and promotes renationalisation and a prevent business strategy at every opportunity, with John McDonnell announcing the expropriation of private assets at a price set by Parliament. So, capitalists must not undermine the prosperity of their workforce or exploit their customers, but enlist their loyalty and cooperation to fight this potential disaster.

Globalisation is not a pernicious and irreversible ratchet – it is a remarkable force for the broadest prosperity, and we are best to let everyone know that. While business wields extraordinary economic and cultural power, it must do so and be seen to do so for the benefit of its shareholders and staff, customers, and society — and now interactive technology can make that happen.

The New Blue Book can be viewed in full at www.newbluebook.com.

____

[1] http://www.edelman.com/news/2017-edelman-trust-barometer-reveals-global-implosion/

Charlotte Black FCSI (Hon) has experience as both a board member and in non-executive roles. She is an experienced champion of major changes in financial market infrastructure with a reputation for campaigning for participants in retail financial markets and on corporate governance issues, as well as her long held interests in the arts and education. She was a Director of Marketing and Public Affairs at Brewin Dolphin for 27 years and Chairman of its Stewardship Committee. Charlotte was also a Non-Executive Director of CrestCo, Euroclear plc, the CISI and the WMA variously between 1996 and 2016.

‘The market is a good servant – but a bad master’. Lord John Eatwell

Capitalism is a vital and positive force and the future of nations and citizens depend on its continuing success, as was well explained in the Government’s Green Paper on corporate governance reform in November 2016. However, trust and confidence in corporate governance has been lost and a chasm opened up between business and its wider stakeholder base. The failings of corporate governors and the long complex supply chain between savers and their underlying shareholdings (most savers are unaware they have a stake) both contribute to this burgeoning discontent.

There is growing disaffection with UK PLC and globalisation more generally and too little corporate engagement with investors, employees, suppliers, and customers. The ever-widening pay gap and one rule for the boss and another for everyone else deepens the fault line. The only shareholders who have the opportunity to vote are institutions, but they are under short-term pressures and often in the same pay group as the bosses they are meant to police, while citizens have no direct relationship with UK plc: there is a need to reconnect.

These grievances add fuel to an ominous anti-capitalist insurgency. How do we make business and bosses more accountable and everyone else aware that we are all stakeholders and that it is in all our interests for business to flourish?

The Government’s response to their consultation reports that 86 per cent of respondents agreed that stakeholders’ voices need to be strengthened – but none concurred how it might be done. The proposals announced in August broadly advocate more transparency about directors’ compliance with their responsibilities to employees and stakeholders under s.172, but are generally flimsy and fail to suggest any new and imaginative ways of engagement. There is a choice of three mechanisms for employee representation on boards, but each of which, the paper acknowledges, has its own drawbacks, and they are unlikely to draw in views of any more than a tiny cohort of discontents.

Meanwhile, the Corbyn-led Labour Party is harking back to sweeping nationalisation as the solution, and denigrating the social liberation of the Blair and Cameron eras, which has delivered prosperity and consumer choice in various degrees to almost all in society. However, corporate Britain — let alone some multinationals — is not behaving or being seen to behave as the new populist generation expect and who now wish to control and tax it more, which is a deadly combination for jobs and prosperity.

The freedom of enterprise from the dead hand of the state is not universally considered a benefit by many these days; they probably don’t remember British Airways and BT as national carriers and general laughing stocks before their privatisation. These and many other flotations led to lower fares and tariffs, expanded and improved services: BA became the world’s favourite airline. But now many seem autocratic, complacent, and out of touch with their staff and the new generation of consumers, despite their obvious successes.

Today three quarters of all households in the UK have some form of invested savings. Soon, through auto-enrolment, which is one of the most promising Government policies in recent times, all working people will have a stake in UK PLC, and should be able to give a view on how it behaves. With fast-developing technology, auto-enrolment should soon lead to a personal valuation of their fund on an individual’s phone, which could follow them from job to job, and from which they could know their principal shareholdings. They will be able to be aware and shop accordingly — e.g. Vodafone not Sky, and Morrisons instead of Tesco, or vice versa – as well as responding to polls on ‘their’ CEOs’ pay or other matters of corporate behaviour.

Such facilities could only be a matter of time away with new smart technologies and will not require complex legislation or regulatory box ticking. Tech could enable us all to put up or shut up on corporate governance matters and dent the socialist argument for coercive and restrictive practices, which are the antithesis of the free market. Encouraging such engagement and transparency will support the fundamental freedoms that allow capitalism to flourish and bring prosperity to all.

Shareholder powers and executive pay

Following political and media pressure, it can be argued that the message on executive pay is beginning to get through, within existing law, to its relatively small audience of interested professional investors. BlackRock, one of the world’s largest investors, recently announced it will not support the re-election of board directors who fail to rein in outsized pay packets. In a letter in January this year to the bosses of more than 300 UK companies, BlackRock, which has a stake in every business listed on the FTSE 100, said that it would only approve pay increases for Directors, if the companies increased workers’ wages by a similar quantum. The Blackrock letter and similar stands taken by Standard Life Aberdeen and other institutions are arguably more powerful than any more rules or regulations.

Nonetheless, there is a need to broaden engagement beyond the narrow cohort of institutional shareholders.

According to Edelman’s 2017 Trust survey [1], we are experiencing a collapse in trust in the institutions and corporations that shape our society. Trust in the UK is at an historic low of only 29 per cent overall and UK business at 33 per cent; this is expected to dwindle further unless business engages with the people and delivers solutions to their concerns. ̍

Encouraging institutional and retail shareholders to use existing powers

Fund managers do mostly report their voting record as part of their obligations under the FRC Code – however, few (of their underlying investors or customers) are aware or interested in finding these records as they are usually buried in the depths of impenetrable websites or annual reports. There is little interest or incentive for these institutions to engage with their underlying clients on matters of corporate governance. Institutional investment managers do an essential job – increasing the value of the nation’s savings, and they see this as their primary function, but not to engage with the public.

It is only when significant numbers of savers and investors are given a role in corporate governance that this tide will turn. Fund managers will have to take more account of the views of their customers and the media will have an incentive to express opinions to a large and receptive audience at last.

There is no wish to undermine the existing nominee custodial arrangements which are the only cost-efficient method of share ownership for small savers and investors. Equally, there is no point in enhancing the rarely used proxy arrangements introduced in 2006 – for which there is little appetite as they are cumbersome and expensive.

Now a new form of stakeholder engagement and communication needs to be developed and is possible using smart technology. For example:

1. Savers’ annual ISA or pension statement could include a free offer to register ‘to have your say’:

2. Option to extend facility to employees and other stakeholders of both public and private companies

3. ‘Votes’ aggregated and supplied to registered shareholder/fund manager/board

4. Poll results published alongside the registered institutional shareholders’ actual votes

5. Registered shareholders either comply with poll ‘advice’ – or explain why not

This ‘enfranchisement’ of even a proportion of the 11m individuals in equity-related savings products today and the soon to be millions more through auto-enrolment, could be akin to the 1980s\ sale of council houses in terms of its political awakening.

How it could work

There are nonetheless challenges as well as opportunities within this proposal:

Savers and investors are notoriously hard to engage and there will need to be a pilot to test public appetite. However, the press will support and provide information on contentious issues and the service will be free to users — it will be simple and with alerts sent direct to users’ phones or inboxes – creating awareness and encouraging action.

Technical developments make it possible and there is a willingness of some of the biggest providers of retail financial services to consider a pilot.

Are not yet quantified – but it is a data management exercise and an opportunity for a customer user interface, possibly a polling organisation, to build databases and provide enhanced services – including information, e.g. PIRC data, user chat rooms, etc.

None should be required as voting/polling would be purely advisory – though political will and support would be a vital ingredient and a spur to the development of a necessary pilot

Strengthening the employee, customer, and wider stakeholder voice

This form of engagement will be straightforward between companies and their employees. Information about strategy, the future plans for the business, and the firm’s remuneration policy could be sent to all permanent employees with an opportunity for staff to express a view anonymously on whatever issues they are invited to comment on. Results would be aggregated and published in a pie on the company intranet. It should also be used to encourage employees to become shareholders. Both would be preferable outcomes to the proposed Designated NEDs, employee councils, or employees on Boards.

Such an advisory polling facility, with voting prior to AGMs as described, should attract much broader engagement and satisfaction. The facility should certainly be extended to employee shareholders and possibly to all permanent employees, account customers, suppliers – shareholders via pensions and ISA wrappers, and indeed whomever the Company wished to engage with. Votes would not be binding and no challenge to Company Law — they would be aggregated and anonymous; it would be their publication that wielded the power.

Boards would soon know if their policies were unacceptable or just misunderstood and would be keen to address any concerns, in fear of poor publicity. FRC guidance would be sought to set parameters for such a facility and agree the form of its reporting.

FTSE 100 and 250 companies should be a manageable aspiration for broad stakeholder participation – perhaps starting with FTSE 100 for the underlying shareholders in pensions and savings schemes. Though any company could join the scheme or not – and would do owing to likely peer and public pressure and the efficacy of the “have your say” app that is developed.

Legislation, code based or voluntary?

All voluntary. Any mandatory requirements would add more complexity with the need for audit trails of potentially huge and confidential data – adding inexorably to costs. As the ‘vote’ or poll would be advisory, votes would be cast anonymously – it would be publicity and peer pressure that would steer boards’ behaviour and ensure remuneration is more closely linked to performance – rather than another tick box exercise.

Private companies…could they be in scope?

The benefits of a stakeholder polling facility would be in the interests of good relations with employees and customers of every company of any size. Though for private companies’, new guidelines may be necessary.

To avoid a BHS type scandal, it should be noted that existing employee rights, auditors’ probity, and the requirements of pension trustees should each have prevented much of the BHS catastrophe. Relevant legislation should be reviewed and strengthened where necessary, but such a scandal could not have been prevented by any corporate governance code, existing or proposed.

Private limited liability companies’ stakeholder engagement will depend on the sector, number of employees, customers and suppliers – say a minimum of 1000 stakeholders in aggregate as suggested in the Government’s August proposals. A code of good practice could be drawn up by the IoD and CBI and while it might include some of what is in place for listed companies, it would need to be tailored specifically and operable within the Companies Act if it were to work well and encourage private business to engage.

Adherence to a best practice code for stakeholder engagement should be voluntary with transparent results. The comply or explain principle applies just as well here. Both public and private corporations are aware of growing distrust and the wave of populism that threatens them, and their attempts to appear more local and ‘caring’ and in touch are increasingly apparent through their social media feeds.

The right combination of high standards and low burdens

The key principles at the heart of UK corporate governance – that is unitary boards and shareholder rights and the voluntary nature of comply or explain with its high standards and low administrative burden – would each be enhanced by broader inclusion of other stakeholders’ views. The awakening of registered shareholders (institutional investors and trustees) acting on behalf of millions of smaller investors, savers, and pensioners in both passive and active funds, should result in more consideration of their responsibilities and engagement with their underlying customers — while these customers would realise that they do have a stake and it is in their interests for the companies in which they are invested to do well, make profits, and to employ the very best talent.

We can’t turn the clock back on global capitalism – it slips around the world with ease – but we can enable savers, employees, and consumers to have a say on how it performs. Labour abandoned its loathing for economic liberalism in the 1980s, leading to the collapse of socialism as a credible programme for government; but now Conservatives must relaunch capitalism, making it more engaging and accountable – to save it from a socialist resurgence. This Labour Party is not bothering with a 1990s’ style prawn-cocktail offensive – it stokes anti-business sentiment and promotes renationalisation and a prevent business strategy at every opportunity, with John McDonnell announcing the expropriation of private assets at a price set by Parliament. So, capitalists must not undermine the prosperity of their workforce or exploit their customers, but enlist their loyalty and cooperation to fight this potential disaster.

Globalisation is not a pernicious and irreversible ratchet – it is a remarkable force for the broadest prosperity, and we are best to let everyone know that. While business wields extraordinary economic and cultural power, it must do so and be seen to do so for the benefit of its shareholders and staff, customers, and society — and now interactive technology can make that happen.

The New Blue Book can be viewed in full at www.newbluebook.com.

____

[1] http://www.edelman.com/news/2017-edelman-trust-barometer-reveals-global-implosion/