The Office for Budget Responsibility is much maligned, but whilst its impact on democratic politics is not good, one cannot help but feel a little sorry for the poor souls charged with drawing up its forecasts.

For the OBR, quite properly, cannot second-guess the Treasury; it can only model the policies the government of the day says it will adopt. That makes lying to it trivially easy.

Consider, by way of example, Rishi Sunak and Jeremy Hunt’s adoption of a ‘rolling’ timeline for bringing down the debt-to-GDP ratio: it was always going to happen in five years’ time, and every year that deadline was extended to keep it five years in the future.

As an actual strategy for reducing debt, this was about as plausible as a diet that always starts tomorrow (which, famously, never arrives). But it was what the Government said it would do, and so the OBR modelled it, doubtless through gritted teeth.

This brings us to the OBR’s latest Economic and Fiscal Outlook (EFO), published in October – and to the £4 billion black hole in the finances into which the Government is likely to stumble next year. Let’s talk about Fuel Duty.

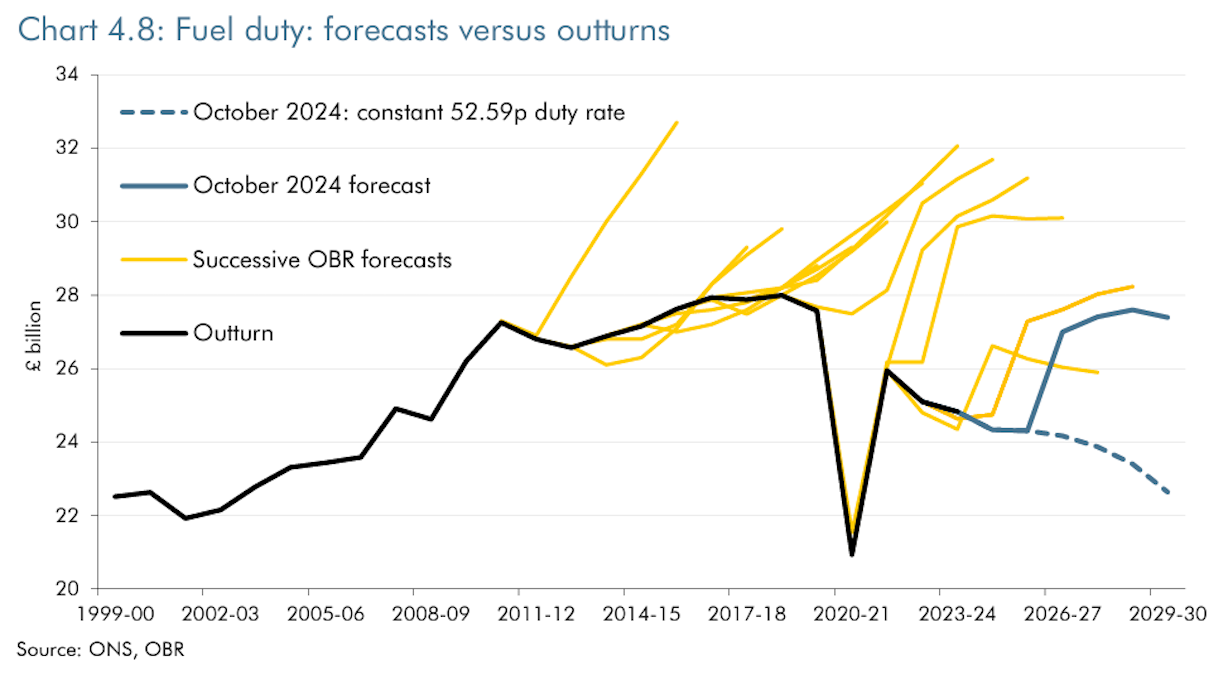

Rachel Reeves, like her Tory predecessors, insists that the days of coddling the motorist are drawing to a close. The Treasury’s plans, which the OBR has modelled, include reversing the 5p cut introduced in 2022 and the re-indexing of fuel duty to the retail price index (RPI).

Yet there is a reason that successive governments shied away from doing this. Compared to the huge and relatively stealthy receipts from things like fiscal drag, fuel duty hikes hit a lot of people in a way that they definitely notice. Both Reeves and Sir Keir Starmer have also repeatedly stated since the Budget that they have “no plans” for new tax rises.

Except they do, and those plans are baked into the OBR’s modelling. Which is why the latter has done everything it can – within its official constraints – to signal its disbelief in its own forecast:

“In practice, these policies have rarely been implemented and the new Government is now continuing this practice. The reversal of the 5p cut has now been delayed three times and fuel duty has not been uprated with RPI since 2011.” (EFO Oct 24, s.4.26)

This acidity isn’t tucked away; it is run through the document’s coverage of fuel duty like a stick of rock. The EFO refers to indexation as “seldom-implemented” in three separate places, and the 2022 cut is one of several ‘temporary’ policies where the temporary is in scare quotes.

If that wasn’t enough, the OBR has also produced this helpful chart, which is such a testament to the futility of its work that it reads like a cry for help. It is the sort of document produced by someone later described as ‘quiet’ when their neighbours are interviewed on the evening news:

Budgetary responsibility is my passion.

So the Government has a problem. Either it is going to whack up fuel duty by 5p in the next budget, and then take repeated hits as it uprates it with RPI for the rest of the parliament, thus asking backbenchers with rural or suburban seats to sign off on a painful, promise-breaking tax hike to which their electorates are particularly exposed…

..or it isn’t, in which case there is, on average, a £3.8bn hole in Reeves’ numbers every year between now and 2026/7 and 2028/9. That means either asking Labour MPs, fresh off the renewing the two-child welfare limit, means-testing the Winter Fuel Allowance, and refusing the WASPIs their lucre, to sign off on even more cuts.

Even better for the Conservatives, the Chancellor has asked the OBR to deliver its next EFO on March 26. That means the Treasury will have to either recommit to this promised tax raid less than two months before the local elections, or kick the can another year down the road and leave Reeves scrambling for billions in cuts in that same sensitive period.

This is by no means the only landmine in the document. For example Zachary Spiro (sometimes of this parish) has highlighted that in the same report the OBR projects productivity growth to “basically be double its 2010-2019 avg by 2028/9”, for no obvious reason, “meaning significant downside risk that Reeves has to come back for more tax”.

And let’s not forget the Chancellor’s decision to bring (overwhelmingly private-sector) defined-contribution pension pots into the ambit of inheritance tax, due to come into force in 2027. That will probably feel like another breach of her tax pledge to the tens of thousands of households affected – and much closer to the next election than the announcement.

(Between that and a whole series of Clarkson’s Farm (likely the 2026 one) dedicated to the plight of the farmers, there may even be space for the Tories to just fight the next election on abolishing death duty, which the country really does just despise even when all the usual arguments are explained to them.)

Decency prescribes limits to how much the Conservatives can enjoy any schadenfreude over this. As I explained last week, many of Labour’s most controversial decisions are just basic responsible government, and any responsible Conservative government in future would be controversial.

But it is undoubtedly better for the Tories that Labour spends the next few years flailing through this parliament, leaving a wake of broken promises and higher bills, than had it arrived in office with any sort of plan.